When you hear the name Andy Fastow, your mind probably jumps straight to one of the biggest corporate scandals in history. Enron’s collapse wasn’t just a financial disaster; it was a wake-up call for businesses worldwide. As the former CFO of Enron, Fastow played a pivotal role in the company’s downfall, and today, his name is synonymous with corporate greed and deception. But what’s happened since? Let’s dive deep into the world of Andy Fastow today and uncover the man behind the headlines.

Fastow’s story isn’t just about numbers and balance sheets. It’s about power, ambition, and the consequences of unchecked greed. His actions didn’t just shake the business world—they changed it forever. From high-flying success to a federal prison cell, Andy’s journey is one of the most fascinating and cautionary tales of modern times.

Now, let’s not sugarcoat this: Andy Fastow’s name brings up a lot of strong feelings. For some, he’s the poster child for corporate corruption. For others, he’s a symbol of what happens when accountability goes out the window. But regardless of how you feel about him, there’s no denying his impact on corporate governance today. So, buckle up, because we’re about to take a deep dive into the life and legacy of Andy Fastow.

- Pooh Shiesty Age The Rising Star In The Music Industry

- Mary Mary Net Worth The Journey Of Gospels Dynamic Duo

Table of Contents:

- Biography: Who Is Andy Fastow?

- Early Life and Education

- The Rise of Enron

- The Scandal Unfolds

- The Fall of Enron

- Andy Fastow Today

- Lessons Learned from Enron

- Impact on Corporate Governance

- Legal Aftermath and Sentencing

- Conclusion: What’s Next for Andy Fastow?

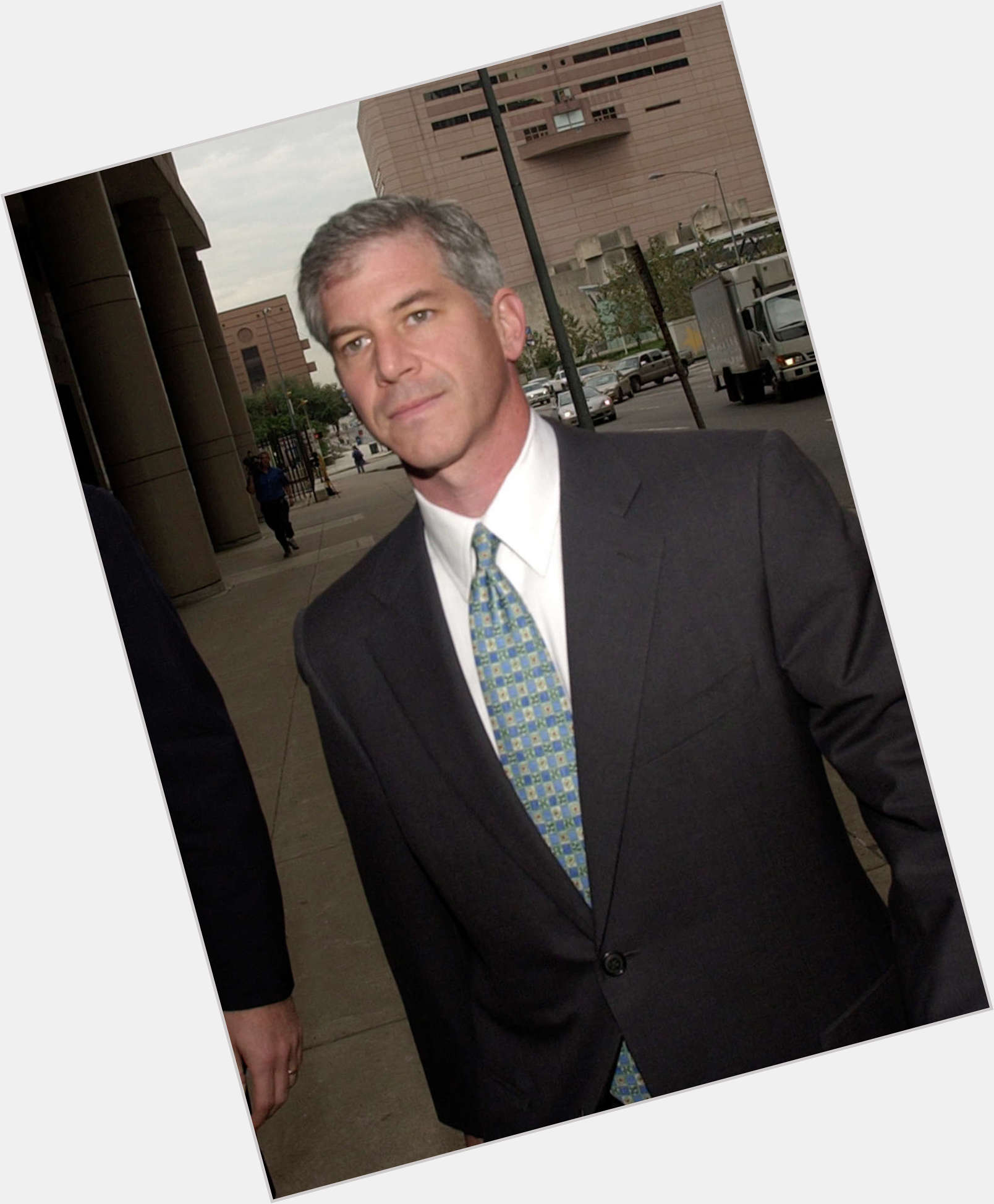

Biography: Who Is Andy Fastow?

Before we dive into the juicy details of Andy Fastow’s scandalous past, let’s take a step back and get to know the man himself. Andy Fastow wasn’t always the villain of corporate America. He started out like any other ambitious young professional, eager to make a name for himself in the world of finance. But somewhere along the way, things took a dark turn.

Early Life and Education

Andrew Stanley Fastow was born on February 28, 1961, in Cleveland, Ohio. Growing up, he was your typical overachiever—smart, driven, and always looking for ways to succeed. After graduating from high school, Andy attended Tufts University, where he earned a degree in economics. From there, he went on to get his MBA from Northwestern University’s Kellogg School of Management. If you’re keeping score, that’s some serious academic firepower.

- Unveiling The Truth The Tragic And Inspiring Story Of The 1972 Andes Crash Site

- Ann Davis Actress The Legendary Career Of A Hollywood Icon

But it wasn’t just his education that set Andy apart. He had a knack for numbers and a talent for thinking outside the box. These skills would later serve him well—but also lead to his downfall. Fastow’s early career was marked by a series of impressive moves, including stints at Continental Bank and Bankers Trust. By the time he joined Enron in 1990, he was already making waves in the finance world.

The Rise of Enron

Enron wasn’t always the corporate villain we know today. In the 1990s, it was seen as a shining example of innovation and success. Founded in 1985, Enron quickly became one of the largest energy companies in the world. But what really set it apart was its approach to business. Enron wasn’t just about selling energy—it was about creating value through complex financial deals and partnerships.

That’s where Andy Fastow came in. As CFO, he was tasked with finding new ways to boost Enron’s bottom line. And boy, did he deliver. Fastow pioneered the use of special purpose entities (SPEs), which allowed Enron to keep massive debts off its balance sheet. At the time, it seemed like pure genius. Investors were thrilled, and Enron’s stock price soared. But as we now know, there was a darker side to this financial wizardry.

The Scandal Unfolds

Here’s where things start to get messy. Fastow’s use of SPEs wasn’t just about creative accounting—it was about hiding the truth. By keeping billions of dollars in debt off Enron’s books, he created a false picture of the company’s financial health. And to make matters worse, Fastow wasn’t just hiding Enron’s problems—he was profiting from them. Through a series of shady deals, he funneled millions of dollars into his own pocket.

But the cracks in Enron’s façade began to show in late 2001. Whistleblowers started coming forward, and regulators launched investigations. The house of cards came crashing down, and Enron filed for bankruptcy in December 2001. It was the largest bankruptcy in U.S. history at the time, and it sent shockwaves through the business world.

The Fall of Enron

When Enron collapsed, it wasn’t just a financial disaster—it was a human one. Thousands of employees lost their jobs, and many lost their life savings when Enron’s stock plummeted. The ripple effects were felt far and wide, from investors to retirees who had trusted Enron with their nest eggs.

For Andy Fastow, the fall was personal. Once a rising star in the business world, he now found himself at the center of a massive criminal investigation. In 2004, Fastow pleaded guilty to two counts of conspiracy and securities fraud. He agreed to cooperate with prosecutors in exchange for a reduced sentence. It was a move that many saw as a betrayal of his former colleagues—but for Fastow, it was a way to save himself.

Andy Fastow Today

So, what’s Andy Fastow up to these days? After serving six years in federal prison, Fastow was released in 2011. Since then, he’s made a surprising career pivot. Believe it or not, Fastow now speaks about corporate ethics and governance. He travels the world, giving talks to business students and executives about the lessons he learned from Enron.

Some people find this ironic—maybe even offensive. After all, Fastow’s actions helped destroy countless lives. But others see value in his message. If anyone knows the dangers of unchecked greed, it’s Andy Fastow. In interviews, he’s often candid about his mistakes, acknowledging that he made terrible choices that had devastating consequences.

Lessons Learned from Enron

The Enron scandal wasn’t just a wake-up call for corporate America—it was a wake-up call for the entire world. Here are just a few of the key lessons we’ve learned from Andy Fastow and the Enron debacle:

- Transparency Matters: Companies need to be open and honest about their financial dealings. Hiding debt or manipulating earnings might seem like a good idea in the short term, but it always catches up with you in the end.

- Accountability is Key: No one is above the law—not even high-powered executives. Enron’s collapse showed us that accountability is essential for maintaining trust in the business world.

- Whistleblowers are Heroes: The people who came forward to expose Enron’s wrongdoing were brave—and right. Without them, the truth might never have come to light.

Impact on Corporate Governance

Enron’s collapse led to sweeping changes in corporate governance. The Sarbanes-Oxley Act of 2002, for example, was designed to prevent future scandals by requiring greater transparency and accountability from public companies. CFOs and other executives now face stricter scrutiny, and companies must adhere to more rigorous standards for financial reporting.

Fastow’s role in the scandal helped shape these reforms. His actions exposed the flaws in the system and highlighted the need for stronger safeguards. While some might argue that these changes have made it harder for businesses to operate, most agree that they’ve made the business world a safer and more trustworthy place.

Legal Aftermath and Sentencing

Fastow’s legal troubles didn’t end with his guilty plea. In addition to his prison sentence, he was ordered to pay $23.8 million in restitution to Enron’s victims. That’s a hefty price tag, but it’s a small fraction of the damage he caused. Many victims still feel that Fastow got off easy, especially compared to other executives who received longer sentences.

But Fastow’s cooperation with prosecutors did pay off. By testifying against his former colleagues, he avoided a much harsher sentence. Some see this as justice; others see it as a double standard. Either way, it’s clear that Fastow’s legal journey was as complicated as the scandal itself.

Conclusion: What’s Next for Andy Fastow?

So, where does Andy Fastow go from here? For now, he seems content to share his story with the world. By speaking about corporate ethics and governance, he’s trying to make amends for his past mistakes. Whether or not you believe in redemption, there’s no denying that Fastow’s story has had a lasting impact on the business world.

As we’ve seen, the lessons of Enron are still relevant today. Transparency, accountability, and integrity are more important than ever in a world where corporate scandals continue to make headlines. By learning from Andy Fastow’s mistakes, we can help ensure that history doesn’t repeat itself.

So, what do you think? Is Andy Fastow a cautionary tale, or a man trying to make amends? Let us know in the comments below—and don’t forget to share this article with your friends. Together, we can keep the conversation going and learn from the mistakes of the past.

- Jd Vance Net Worth The Rise Of A Political Figure And Bestselling Author

- Ernest Borgnine The Imdb Legend Who Left An Indelible Mark On Hollywood